In our new “Credits by the Hour” CE package, you can choose how many continuing education hours you need and handpick the courses that fit your schedule and interests — all at a discounted rate. We’ve made meeting your CE requirements as simple, quick, and flexible as possible.

Simply choose the number of hours you need. They will be charged at $5 per hour, up to 24 hours, at which point you will get a bulk discount so that 24-hour packages are only $49.

We offer a variety of engaging course options that are easy to follow, clear, and designed to get you through the process efficiently. No matter how many hours you need, this package allows you to meet your CE goals without overpaying or sitting through courses that don’t interest you.

Once you purchase the number of hours you need, you’ll log into your personal All-Lines Training dashboard, where you’ll choose the courses you’d like to take.

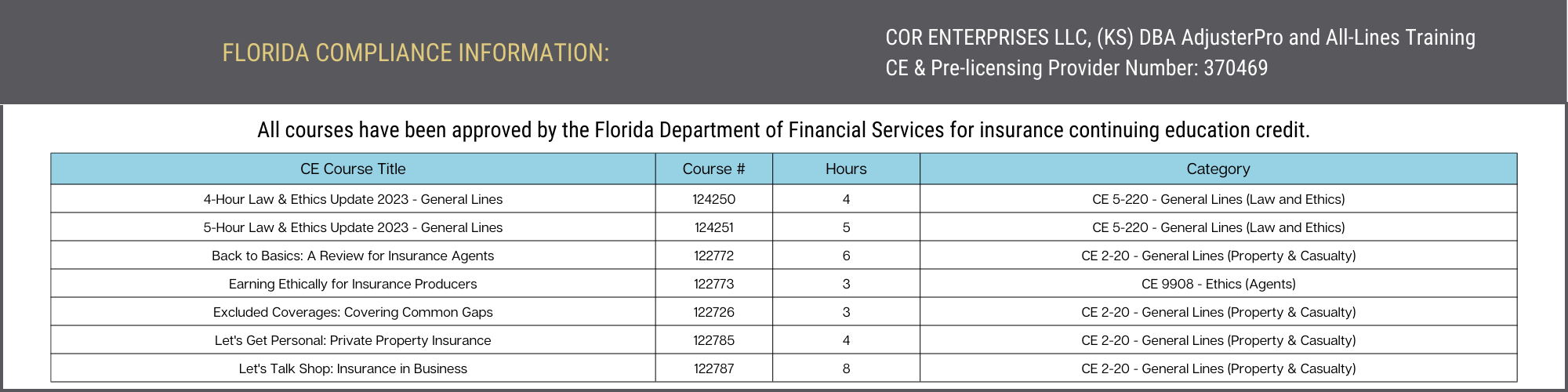

View “Full Details” to see a list of course options available to add to your personal classroom. We’ve also included compliance information so you’ll know the ins and outs of license renewal.

REQUIRED FOR RENEWAL: Florida 4-Hour Law & Ethics Update