Our team is passionate about providing the best insurance training courses and online classroom experience in the industry. We started small, with just a few courses that focused on the insurance adjuster market. But after releasing adjuster courses for every state, we’re focused on taking our national solution to the producer market.

We are committed to helping you succeed at every step of your insurance career. All-Lines Training has actually been a business for far longer than most people realize. We’ve offered our Florida courses under the AdjusterPro brand for years and now going to expand our All-Lines offerings to include all things agent!

At All-Lines Training, we believe in serving our customers with transparency, honesty, and adhering to the Golden Rule, treating others as we would want to be treated.

Building our company upon these principles, here are a few other ways we differentiate from the competition:

- All-Lines Training is a part of AdjusterPro, the nation’s leading provider of adjuster licensing and training. AdjusterPro has been in business for over 10 years and has trained over 50,000 adjusters. We also serve 8 of the country’s top 10 insurance carriers.

- Our simple, engaging online training was created to help you comprehend and retain information

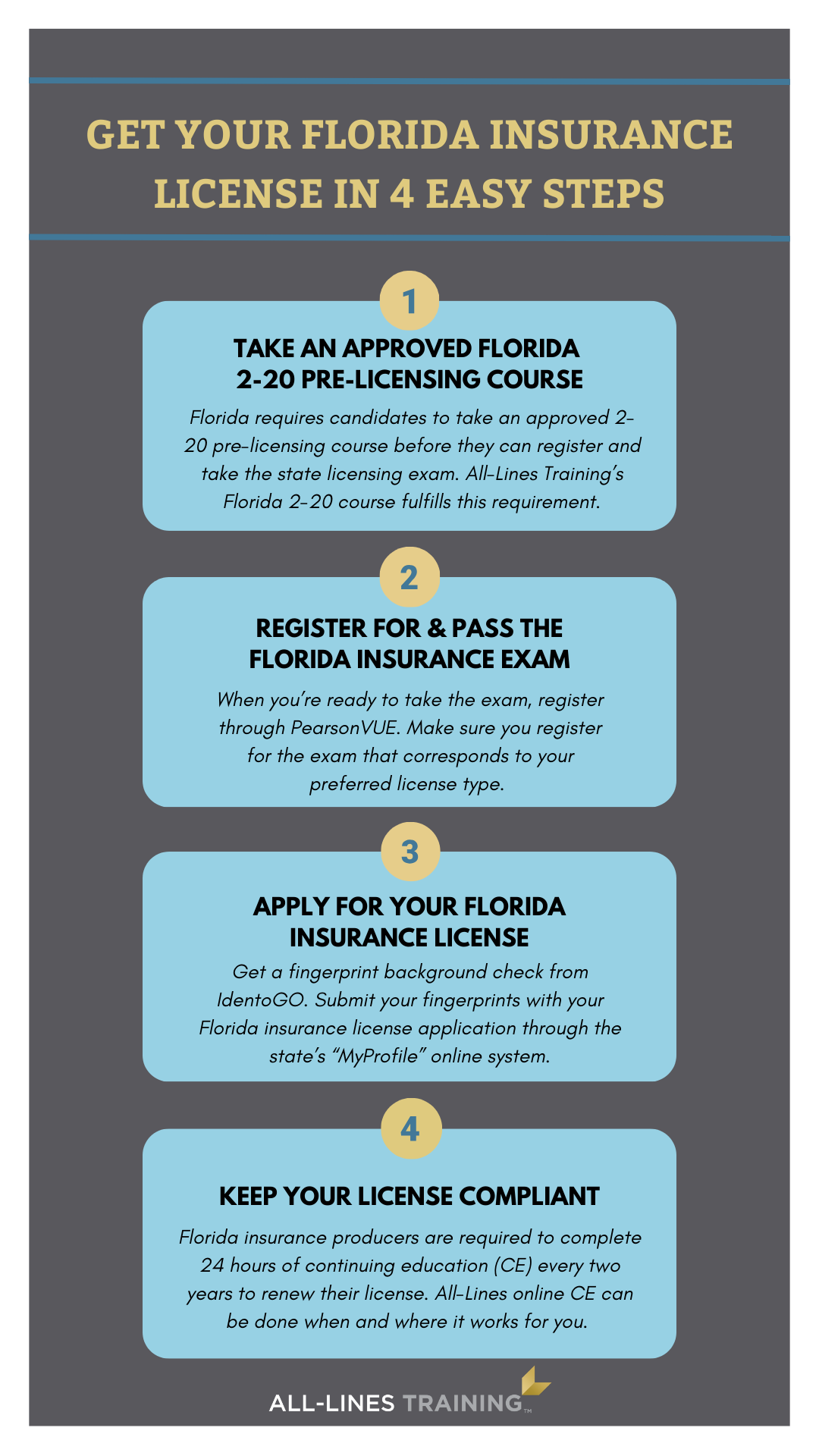

- Keeping your license compliant is simple with our convenient continuing education courses

- You’ll receive honest answers from our dedicated (real-people) customer engagement team

- 98.4% customer satisfaction rating

Whether you are just starting to explore the insurance industry or a Fortune 500 company, All-Lines Training is here to help you reach your goals and achieve success.